Table of Contents

- Premarket: 6 things to know before the bell

- Premarket Trading: Everything You Need to Know | The Motley Fool

- Premarket Stock Trading - CNN Business

- Premarkets: 5 things to know before the open

- Premarket Trading: How it Works, Hours & Key Market Movers - DTTW™

- Premarkets: 5 things to know before the open

- 3 hours into premarket with only 300 shares traded???? Wut doing ...

- Premarket: 6 things to know before the bell

- Premarkets: 5 things to know before the open

- How CNBC Premarket Can Boost Your Investment Strategy » CNBC Posts

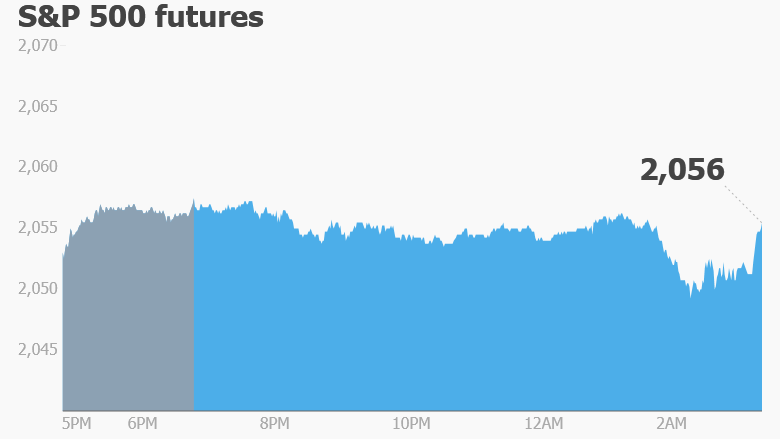

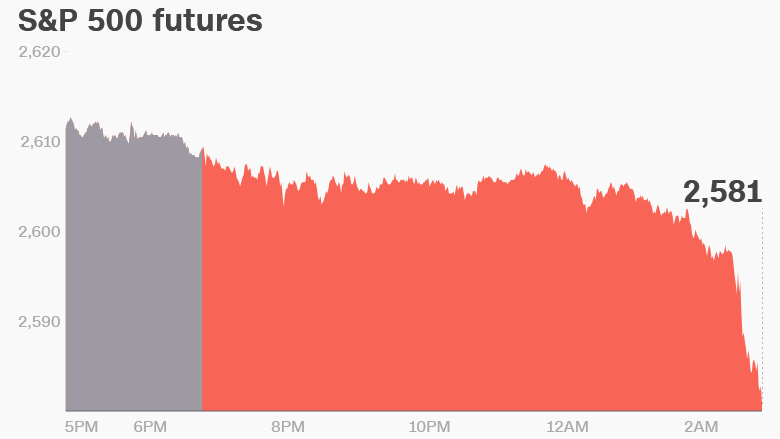

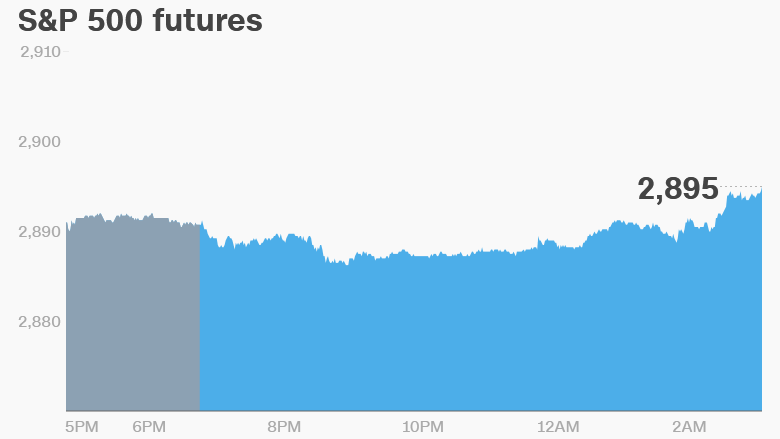

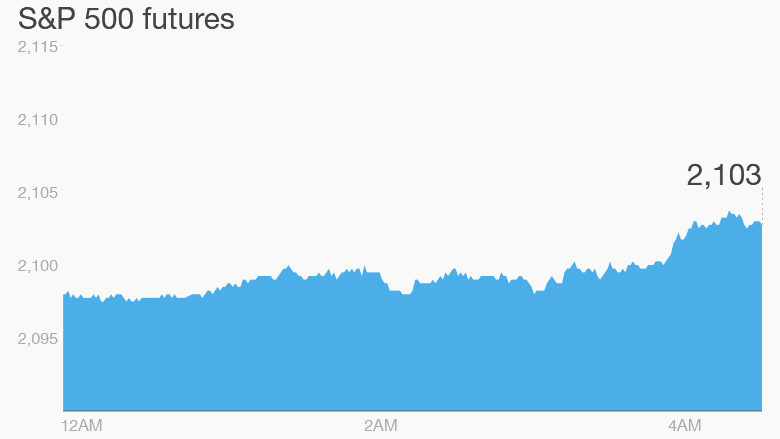

What are Stock Futures?

How Do Stock Futures Work?

Why Check Premarket Prices?

Checking premarket prices on Dow futures, S&P futures, and other indices is essential for investors and traders. Premarket prices, also known as pre-market futures, reflect the expected opening price of a stock or index before the regular trading session begins. By monitoring premarket prices, investors can: Gauge market sentiment: Premarket prices can indicate the overall mood of the market, helping investors anticipate potential trends and make informed decisions. Identify potential opportunities: By analyzing premarket prices, investors can spot potential buying or selling opportunities, allowing them to adjust their portfolios accordingly. Manage risk: Premarket prices can help investors assess potential risks and adjust their strategies to minimize losses or maximize gains.